Finance for Strategic Managers Certificate – Accounting

September 18, 2023 2024-11-03 21:36Finance for Strategic Managers Certificate – Accounting

Finance for Strategic Managers - Accounting Professional Certificate

Finance for Strategic Managers melds accounting principles with strategic management to guide decisions for sustainable business growth.

- 10% exemption from our MBA Programs

- 1 Course

- 36 Hours

- 15 Lessons

- CMI Certificate

- Certifeka Certificate

- 3 Months Access

Course Overview

Finance for Strategic Managers (Accounting) refers to the specialized area of finance that integrates accounting principles with strategic management concepts. It focuses on understanding financial data and its implications, helping strategic managers make informed decisions that align with an organization's long-term objectives. By blending traditional accounting practices with strategic insights, managers are better equipped to navigate the financial complexities of business and drive sustainable growth.

Course Curriculum

Financial Data

Financial data comprises quantitative information vital for business strategy, risk assessment, and investment decisions. It empowers organizations to make informed choices, manage financial risks, and evaluate the potential of capital expenditures.

Lessons

- Understanding financial information, needs and sources

- Understanding Business Risk

- Introduction to Capital Budgeting

Fundamentals of Financial Accounting

Financial Accounting Fundamentals encompass the ability to interpret financial statements, offer financial recommendations, and evaluate a business’s current viability through comparative financial data analysis.

- Essential Accounting and Financial Reports

- Introduction to Financial Accounting

- Financial Accounting Recording Process

- Accounting for Merchandize Operation

- Inventory Accounting

- Understanding Account Receivable

- Accounting for Fixed Assets

- Understanding Cash Flow Statement

- Financial Statement Analysis

Strategic Financial Decisions

Strategic financial decisions encompass understanding the impact of creative accounting techniques, prioritizing cash flow management in capital expenditure evaluations, and utilizing diverse sources of financial data for informed business strategy.

- Creative Accounting and Investment Decision

- Cash Flow Management and Expenditure Proposals

- Sources of Finance Identification and suitability

Learning outcomes

Reflective Decision-Making

Mathematical Proficiency

Business Acumen

Organizational Skills

Organizational Skills

Teamwork and Communication

Technical and Analytical

Prowess

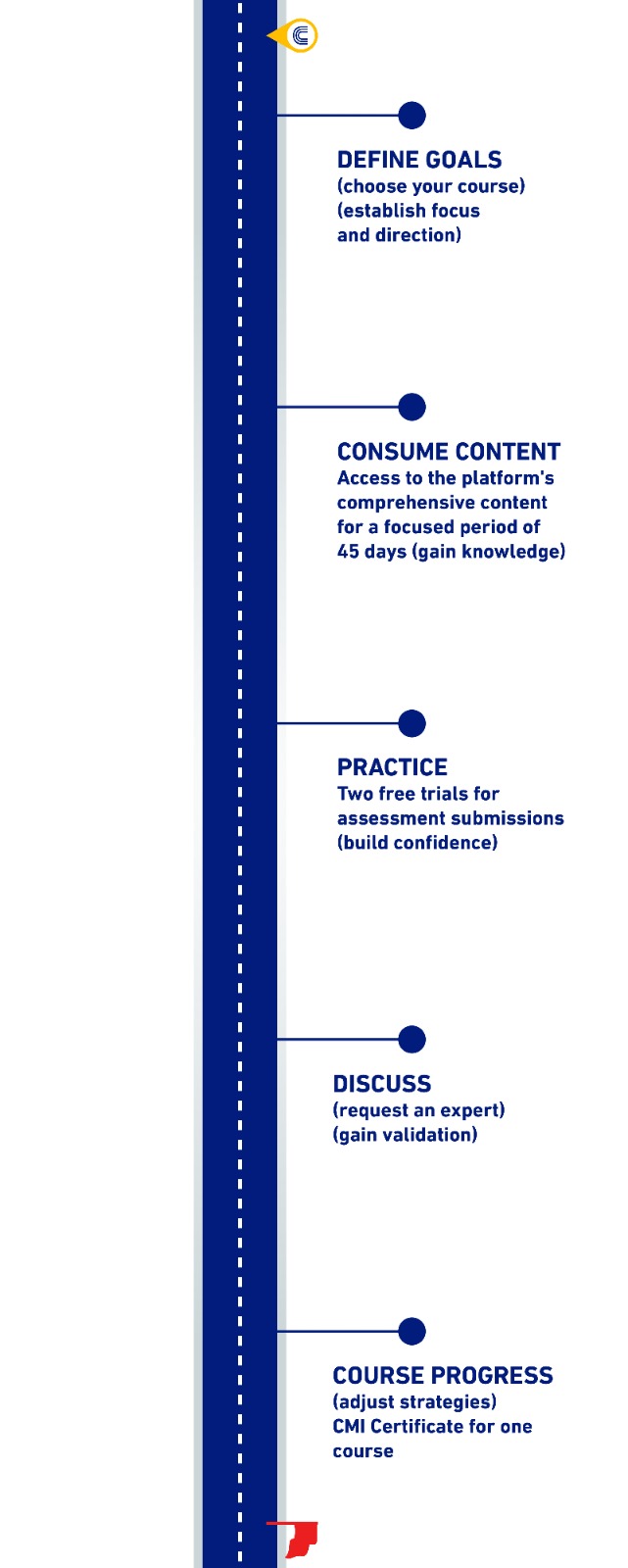

Professional Certification Learning Journey

Now you can have a CMI Certificate

and become Certified

Benefits of having CMI Certificate

Career Advancement: CMI qualifications can open doors for career advancement and promotion by equipping you with the skills and knowledge needed for management roles.

Enhanced Credibility: Holding a CMI certificate enhances your credibility in the business world as it signifies your commitment to professional development and high management standards.

Increased Earning Potential: Many employers value CMI qualifications, which can lead to higher salaries and increased earning potential over time.

Access to Resources and Network: CMI membership provides access to valuable resources, networking opportunities, and a professional community that can support your ongoing professional growth and development.

Don’t miss the chance and enroll now for $700